phreakwars

Well-Known Member

- Joined

- Feb 8, 2005

http://www.cbpp.org/...?fa=view&id=966

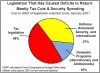

The new Congressional Budget Office budget projections released today show that the nation faces a fourth consecutive year of substantial budget deficits. Some seek to portray “runaway domestic spending” or growth in the costs of entitlement programs as the primary cause of the shift in recent years from sizeable surpluses to large deficits. Such a characterization is incorrect. In 2005, the cost of tax cuts enacted over the past four years will be over three times the cost of all domestic program increases enacted over this period.

The new CBO data show that changes in law enacted since January 2001 increased the deficit by $539 billion in 2005. In the absence of such legislation, the nation would have a surplus this year. Tax cuts account for nearly half — 48 percent — of this $539 billion in increased costs. [1] Increases in program spending make up the other 52 percent and have been primarily concentrated in defense, homeland security, and international affairs.

View attachment 2858

Furthermore, under the new CBO projections, total federal spending will remain lower in 2005, as a share of the economy, than in any year from 1975-1996. As this indicates, federal spending is not at an unusually high level, even with the large increases in spending for Iraq and anti-terrorism efforts. The deficits that the nation now faces reflect not an unusually high level of spending, but rather an unusually low level of revenue. Indeed, CBO projects that federal revenues will be lower as a share of the economy in 2005 than in all years of the 1960s, the 1970s, the 1980s, and the 1990s.

15% just a measly 15% is what all those welfare and entitlement programs are costing us all, where's that proof about lower taxes being so great? Where are the created jobs? Don't blame the free market capitalist giants who move jobs over seas, it WAS a free market after all.

.

.

.

.

The new Congressional Budget Office budget projections released today show that the nation faces a fourth consecutive year of substantial budget deficits. Some seek to portray “runaway domestic spending” or growth in the costs of entitlement programs as the primary cause of the shift in recent years from sizeable surpluses to large deficits. Such a characterization is incorrect. In 2005, the cost of tax cuts enacted over the past four years will be over three times the cost of all domestic program increases enacted over this period.

The new CBO data show that changes in law enacted since January 2001 increased the deficit by $539 billion in 2005. In the absence of such legislation, the nation would have a surplus this year. Tax cuts account for nearly half — 48 percent — of this $539 billion in increased costs. [1] Increases in program spending make up the other 52 percent and have been primarily concentrated in defense, homeland security, and international affairs.

View attachment 2858

Furthermore, under the new CBO projections, total federal spending will remain lower in 2005, as a share of the economy, than in any year from 1975-1996. As this indicates, federal spending is not at an unusually high level, even with the large increases in spending for Iraq and anti-terrorism efforts. The deficits that the nation now faces reflect not an unusually high level of spending, but rather an unusually low level of revenue. Indeed, CBO projects that federal revenues will be lower as a share of the economy in 2005 than in all years of the 1960s, the 1970s, the 1980s, and the 1990s.

15% just a measly 15% is what all those welfare and entitlement programs are costing us all, where's that proof about lower taxes being so great? Where are the created jobs? Don't blame the free market capitalist giants who move jobs over seas, it WAS a free market after all.

.

.

.

.