-

Posts

3,951 -

Joined

-

Last visited

-

Days Won

78

Content Type

Profiles

Forums

Blogs

Events

Articles

Downloads

Gallery

Everything posted by hugo

-

Housing Fix By Robert Samuelson "Decline in Home Prices Accelerates" -- Page One headline, The Wall Street Journal, Feb. 27 WASHINGTON -- Gloom. Doom. Calamity. Home prices are tumbling. We're bombarded by somber reports. But wait. This is actually good news, because lower home prices are the only real solution to the housing collapse. The sooner prices fall, the better. The longer the adjustment takes, the longer the housing slump (weak sales, low construction, high numbers of unsold homes) will last. It's elementary economics. Pretend that houses are apples. We have 1,000 apples, priced at $1 each. They don't sell. We can either keep the price at $1 and watch the apples rot. Or we can cut the price until people buy. Housing is no different. Even many economists -- who should know better -- describe the present situation as an oversupply of unsold homes. True, there is about 10 months' supply of existing homes as opposed to four a few years ago. But the real problem is insufficient demand. There aren't more homes than there are Americans who want homes; that would be a true surplus. There's so much supply because many prospective customers can't buy at today's prices. By definition, the "housing bubble" meant that home prices got too high. Easy credit, lax lending standards and panic buying raised them to foolish levels. Weak borrowers got loans. People with good credit borrowed too much. Speculators joined the circus. Look at some numbers from the National Association of Realtors. From 2000 to 2006, median family income rose almost 14 percent to $57,612. Over the same period, the median-priced existing home increased about 50 percent to $221,900. By other indicators, the increase was even greater. But home prices could not rise faster than incomes forever. Inevitably, the bust arrived. Credit standards have now been tightened, and the (false) hope of perpetually rising home prices -- along with the possibility of always selling at a profit -- has evaporated. For many potential buyers, prices have to drop for housing to become affordable. How much? No one really knows. There is no national housing market. Prices and family incomes vary by state, city and neighborhood. Prices rose faster in some areas (Los Angeles, Miami, Phoenix) than in others (Dallas, Detroit, Minneapolis). Some economists now expect an average national decline of about 20 percent. The Federal Reserve estimates that owner-occupied real estate is worth almost $21 trillion. A 20 percent reduction implies losses of about $4 trillion. The largest part would be paper losses for homeowners: Values that rose spectacularly will now fall less spectacularly -- back to roughly 2004 levels; that's still 30 percent or so higher than in 2000. But hundreds of billions of dollars of other losses are already being suffered by builders (from the lower value of land and home inventories), mortgage lenders (from defaulting loans), speculators and homeowners (from lost homes). Mark Zandi of Moody's Economy.com estimates that mortgage defaults this year will exceed 2 million, up from 893,000 in 2006. To be sure, all this weakens the economy. No one relishes evicting hundreds of thousands of families from their homes. Eroding real estate values make many consumers less willing to borrow and spend. Some economists fear a vicious downward spiral of home prices. More foreclosures depress prices, increasing foreclosures as people abandon houses where the mortgage exceeds the value. Losses to banks and other lenders rise, and they curb lending further. Particularly vulnerable would be Fannie Mae and Freddie Mac, the two government-sponsored housing lenders (their vulnerability emphasizes the need for Congress to pass legislation strengthening regulation of Fannie and Freddie). Up to a point, there's a case for providing relief to some mortgage borrowers. In many cases, everyone would gain if lenders and borrowers renegotiated loan terms to reduce monthly payments. Losses to both would be less than if their homes went into foreclosure and were sold. The Treasury has organized voluntary efforts. Some measures being considered by Congress (for example: overhauling the Federal Housing Administration) might help. But other proposals -- particularly empowering bankruptcy judges to reduce mortgages unilaterally -- would perversely hurt the housing market by raising the cost of mortgage credit. Lenders would increase interest rates or down payments to compensate for the risk that a court might modify or nullify their loans. The understandable impulse to minimize foreclosures should not serve as a pretext to prop up the housing market by rescuing too many strapped homeowners. Though cruel, foreclosures and falling home values have the virtue of bringing prices to a level where housing can escape its present stagnation. Helping today's homeowners makes little sense if it penalizes tomorrow's homeowners. An unstoppable free-fall of prices seems unlikely. Slumping home construction and sales have left much pent-up demand. What will release that demand are affordable prices. Copyright 2008, Washington Post Writers Group

-

Your inventory control system needs improvement. I would start with increasing the minimum stock level.

-

And Obama goes back to the plantation in November.

-

This Tuesday is the end of the line for Hillary.

-

Do wedgies count as a violent act?

-

Let me remind you the title of this post is "women more violent than men?" It is not "women more likely to engage in a violent action than men?" In my mindset murdering someone is many times more violent than slapping someone. One murder is equivalent to a million slaps. Do you disagree? From the department of justice

-

I disagree completely. Murdering someone is more violent than slapping someone. Men commit 8 times more murders not because their physical strength results in death instead of a bruise. Usually a firearm or other weapon is used. It is because 90% of the time the intent to kill is there. Killing someone is more violent than slapping someone.

-

I guess if you consider spanking violence, since women are the primary caregivers, you could be right. You have done the same thing to the word violence that civil rights "leaders" have done to the word discrimination. Let me repeat: If you can equate serial killer Ted Bundy and a serial slapper woman you may have an argument. I can't equate the two. My wife slaps me--one point on the violence scale. An Islamic extremist flies a 757 into the WTC ----100,000 points on the violence scale. If ya got a choice between being murdered or slapped three times a day for the rest of your life what would you choose?

-

Just from your own personal experience how many men do you think get raped every year? Do you think it is as many as women?

-

If you can equate serial killer Ted Bundy and a serial slapper woman you may have an argument. I can't equate the two.

-

The study relies on self reporting your own poor behavior. A man hitting a woman is more frowned upon than vice versa. Men would be less likely to report abusing a woman or child. Piss poor study.

-

Nearly 100% of homicides are reported. They represent the top of the triangle. The overwhelming numbers of individuals hospitalized due to an act of violence are overwhelminlgy put in that hospital by a male. You can not equate a slap with a shooting in any rational discussiuon of violence. Violent males are also more likely to take aggressive actions against their own self. That explains the suicide rate differential.

-

Of course, every statistic I have ever seen shows men are way more violent, backs up what you would assume based on biology.

-

The fact is there is a positive correlation between high testerone levels and violence.

-

That is why I used homicide. Homicides tend to be close to 100% reported. Any first year biology student can tell you about testerones relationship to aggression. To argue women are more violent goes against any statistic you can find and basic biology.

-

Homicides are the peak of the triangle, would you like statistics on assault? You will find the same pattern. Any group that commits 8 times more homicide is more violent than the group it is being compared with.

-

Don't get me wrong we got serious problems in the mid and long term from pension and senior healthcare obligations. The fact is those problems are even bigger for Europe, Japan and China. There are three possible solutions, or realistically a combination of the three, to overcome future massive deficits 1) tax increases 2) benefit cuts 3) expanded immigration. Europe already is crowded and their pool of immigrants come from a group with a nasty tendency to strap bombs to their chests and detonate them in crowded market places.

-

---------------- Victims Offenders -------------- Male Female Male Female All homicides 76.5% 23.5% 88.8% 11.2% Males are 8 times more likely to commit homicides. Males are much more violent. It's biology combined with greater economic pressures on males.

-

The fact is a weaker dollar is good for US jobs,; Economics 101. The fact is service sector jobs include attorney, physician and accountant. The income stagnation of the last generation is primarily due to corporations battling rising healthcare costs due to government interference in healthcare. Employees are receiving more of their wages in the form of health insurance, lowering the dollar wage. Japan has been running trade surpluses since WWII, their economy has been in the tubes for a generation as they are forced to compete against low chink labor. The US economy smartly moved to the service sector. Germany's unemployment rate is over 8%.

-

Ya caint read too well.

-

Leading export nations Germany $ 1,361,000,000,000 2007 est. European Union $ 1,330,000,000,000 2005 China $ 1,221,000,000,000 2007 est. United States $ 1,140,000,000,000 2007 est. Japan $ 665,700,000,00 We export a hell of a lot we just import a hell of a lot more. Milton Friedman:

-

I'm doing pretty good. Ain't gotta worry about Muslims raping my nieces. The dollar will be 10% higher against the euro in one year.

-

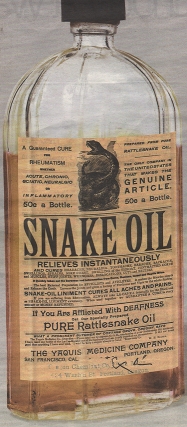

Economists Against the FDA September 1, 2000 Daniel B. Klein A sulfa drug called Elixir Sulfanilamide released in 1937 killed over 100 Americans, mostly children. A sedative called Thalidomide released in Europe in 1957 and taken by pregnant women caused deformities in 10,000 children. These famous episodes strike us as horrible injustices that must be prevented. But more deadly are quack platitudes that guide public policy. Platitudes such as ?safety,? ?consumer protection,? and ?imperfect information? have paved the way for a government stranglehold on the pharmaceutical industry. The Food and Drug Administration (FDA) decides whether to permit a company to manufacture and sell a drug or medical device and what the company may say about it. In medical matters, expertise and good sense should decide. In policy matters, expertise and good sense also should decide?but they do not. The issue here is one of economic policy, not medicine. The true ?doctors? for drug policy are the political economists. But as economist John Calfee says, ?the FDA has never sought to accumulate expertise in economics.?1 Quacks make policy against the doctors? orders. Many economists have studied the FDA. Their diagnosis is well expressed by Nobel-winning economist Milton Friedman: ?The FDA has done enormous harm to the health of the American public by greatly increasing the costs of pharmaceutical research, thereby reducing the supply of new and effective drugs, and by delaying the approval of such drugs as survive the tortuous FDA process.?2 Other economists? prescriptions regarding the FDA are uniformly libertarian, ranging from gradual decontrol to outright abolition of the agency (as Friedman recommends). Although one can occasionally find remarks by economists vaguely favoring government restrictions on health products, those are not the economists who have written on the FDA or provided serious argumentation.3 I have tried to survey all economists? writings on the FDA and have not been able to find a single instance of an economist defending the contemporary FDA or advocating tighter restrictions. Contrary to the joke about laying all the economists end to end, those who study the issue do reach a conclusion: Relax restrictions on drugs and devices. But the good policy doctors are largely ignored. The result has been like a plague. Yet the journalists and educators have not explained it or its FDA origins. Economists and libertarians are up against a Goliath?the country?s entire quack political culture. Today men with risk of heart trouble know to take half an aspirin a day. By 1988 it was well established that aspirin greatly reduces the risk of myocardial occlusion. But for years the FDA forbade aspirin makers from advertising that fact (the FDA still significantly restricts advertising about it). The FDA surely killed tens, and quite possibly hundreds, of thousands of Americans by this restriction alone.4 The FDA delays, stifles, and suppresses life-saving drugs and devices. Such drugs and devices as Practolol, Interleukin-2, Taxotere, Vasoseal, Ancrod, Glucophage, Navelbine, Lamictal, Ethyol, Photofrin, Rilutek, Citicoline, Panorex, Femara, Prostar, Omnicath, and Transform have been subject to long delays, killing tens of thousands and causing awful suffering.5 The drug delays we can list, taken together, are just the tip of the iceberg. A 1987 study catalogued 192 generic and 1,535 brand-name tested drugs available abroad but not approved in the United States. Of the drugs approved by the FDA between 1987 and 1993, fully 73 percent had already been approved abroad.6 And because the FDA process is so expensive, so protracted, and so uncertain, thousands of untold drugs are never discovered or developed. It is impossible to estimate the suffering and death caused, but surely it greatly exceeds 50,000 premature deaths annually. Quality and Safety Assurance Without the FDA: Four Proofs Although some might tell you otherwise, voluntary society (plus the tort system) can provide assurance at least as well as government intervention can. Here are four empirical proofs of the claim. Assurance in Other Industries. How is safety assured in other industries? In electronics, manufacturers submit products to Underwriters? Laboratories, a private organization that grants its safety mark to products that pass its inspection. The process is voluntary: manufacturers may sell without the UL mark. But retailers and distributors usually prefer the products with it. Suppose someone proposed a new government agency that forbade manufacturers from making any electronic product until approved by the agency. We would think the proposal to be totalitarianand crazy. But that is the system we have in drugs. It is inconsistent to favor the free-enterprise approach to assurance in electronics but the totalitarian approach in drugs. Sometimes people rejoin: ?You can?t compare drugs to a toaster! Drugs have much larger effects on our physical well-being.? The point, however, cuts both ways. Because drugs are so important, the downside of government restrictions is enormous?as we have seen. Calamity Before 1962? The FDA was much less powerful before 1962. The historical record-decades of a relatively free market up to 1962?shows that free-market institutions and the tort system succeeded in keeping unsafe drugs to a minimum. The Elixir Sulfanilamide tragedy (107 killed) was the worst in those decades.9 (Thalidomide was never approved for sale in the United States.) The economists Sam Peltzman and Dale Gieringer have made the grisly comparison: the victims of Sulfanilamide and other small tragedies prior to 1962 are insignificant compared to the death toll of the post-1962 FDA.10 Even without government approval, voluntary institutions and the tort system would use scientific testing and professional certification to screen out unsafe drugs. The government approval process here and abroad is a set of bureaucratic hoops and hurdles often inappropriate or unnecessary for the drugs in question. The Hidden Lesson in Off-Label Prescribing: Proof that we don?t need FDA approval of drugs can even be found in America today. A drug?s FDA-approved uses are called its ?on-label? uses. Once a drug is approved for any use, it may be used in any way doctors and users see fit. Approved drugs are often found to have other benefits, and doctors learn to prescribe those drugs for such ?off-label? uses. Although off-label uses have absolutely no standing with or approval by the FDA, they are perfectly legal. Do patients and doctors shrink in fear from uses not certified by the FDA? Absolutely not! Off-label prescribing is pervasive and vital to the health of millions of Americans. As economist Alexander Tabarrok says, ?most hospital patients are given drugs which are not FDA-approved for the prescribed use.?14 Off-label prescriptions are especially common for AIDS, cancer, and pediatric patients, but are standard practice throughout medicine. Doctors learn of off-label uses from extensive medical research, testing, newsletters, conferences, seminars, Internet sources, and trusted colleagues. Scientists and doctors, working through professional associations and organizations, make official determinations of ?best practice? and certify off-label uses in standard reference compendia such as AMA Drug Evaluations, American Hospital Formulary Service Drug Information, and US Pharmacopoeia Drug Information?all without FDA meddling or restriction. Economist J. Howard Beales finds that off-label uses that later got FDA recognition appeared in the Pharmacopoeia on average 2.5 years earlier.15 Where voluntary society finds room to stand, its practices lead, not follow, government determinations. No one would be foolish enough to suggest that the FDA prohibit off-label prescribing. But as Tabarrok astutely points out, there is a logical inconsistency in allowing off-label prescribing and requiring proof of efficacy for the drug?s initial use. Logical consistency would require that one either oppose off-label uses and favor initial proof of efficacy, or favor off-label prescribing and oppose initial proof-of-efficacy. Experience recommends the second option. Efficacy requirements should be dropped altogether! Quackery Often Prevails A drug may be developed, tested, and found to save lives. But the FDA will prevent Eli Lilly, Rite Aid, and Kaiser Permanente from making the drug available until it has gone through the tortuous and expensive approval process. That might take ten years. It might take forever if the drug is for a rare disease (and hence a small market). Because voluntary society would accomplish anything that the FDA accomplishes, the harms of the FDA are unredeemed. Economists from Adam Smith to Milton Friedman have had the unenviable task of pointing out that popular, well-intentioned cures are often worse than the disease. Economists seem nasty when they report that the FDA is bad medicine. People don?t like to hear that they have bought into quackery. In collective decision-making, quackery often prevails over sense.

-

The FDA, by preventing or delaying good drugs from entering the market has killed many times more people than it has saved. The FDA blocked beta-blockers in the 60's resulting in thousands of extra deaths yearly from heart attacks. In the 1980's the FDA restricted AIDS drugs when without then AIDS was a death sentence. The FDA also limits competition and vastly increases drug prices. Limiting competition results in less available drugs and higher costs.